Hard agree, and not just because I'm a spreadsheet nerd. Why are we all here? Isn't it in the service…

News 6/26/19

Top News

UnitedHealth Group acquires PatientsLikeMe, whose China-based key investor was forced by the US government to sell the company for national security reasons.

Reader Comments

From Asking for a Friend: “Re: Change Healthcare, Phreesia IPOs. I’m wondering if your readers have advice for interviewing with a company that is planning an IPO. Is it a good time to hire on, or does the IPO create its own type of workplace unrest?” I’ll open it up to readers since I have no experience in that area. My cheap seats observation is that companies are usually in go-go mode before doing an IPO and are not looking to cut back, making hiring on as a new employee attractive. However, Change Healthcare is an exception because it’s really more like a merger (Emdeon and McKesson’s IT business) in which synergies are being sought in reducing headcount and streamlining product offerings. Change is also challenged by factors that aren’t typical of an IPO company – being saddled with billions in merger-related debt, unimpressive revenue growth, a stable of cast-off products from its majority owner McKesson, and a rapidly changing health IT market that might not be the perfect time to start running on the quarter-by-quarter investor treadmill. Still, given that you can’t predict any company’s future, and given the ephemeral nature of much employment these days, I would say take the best job offer, with slight preference toward companies that are about to IPO. I’ve worked for both good and not-as-good organizations, and while a bad boss spoiled the former, a good one didn’t save the latter.

Webinars

July 18 (Thursday) 2:00 ET. “Healthcare’s Digital Front Door: Modernizing Medicine’s Mobile-First Strategies That Are Winning Patient Engagement.” Sponsor: Relatient. Presenters: Michele Perry, CEO, Relatient; Michael Rivers, MD, director of EMA Ophthalmology, Modernizing Medicine. Providers are understandably focused on how to make the most of the 5-8 minutes they have on average with a patient during an exam, but what happens between appointments also plays a significant role in the overall health of patients. Modernizing Medicine is driving high patient engagement with best practice, mobile-first strategies. This webinar will describe patient engagement and the challenges in delivering it, how consumerism is changing healthcare, and how to get started and navigate the patient engagement marketplace.

Previous webinars are on our YouTube channel. Contact Lorre for information.

Acquisitions, Funding, Business, and Stock

Private equity firm The Jordan Company acquires electronic health and dental information exchange platform vendor Vyne from PE firm Accel-KKR, which bought the company five years ago.

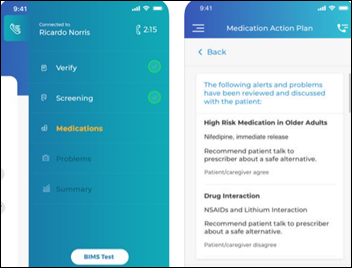

Humana will offer medication management services to its Medicare Advantage members through Aspen RxHealth, which links consumers to virtual visit pharmacists via the company’s consumer app.

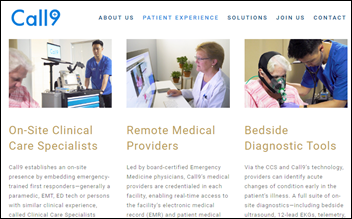

Call9, which offers nursing homes a 24×7 onsite first responder who is backed up by a remote ED doctor to prevent avoidable resident ED visits, shuts down and lays off 100 employees as it runs out of money despite having raised $34 million. The company hoped to share cost savings with insurers, but says value-based care was too slow in coming. High-profile investors included 23andMe’s Ann Wojcicki and Ashton Kutcher.

The Wall Street Journal reports that drugmaker AbbVie – which sells the #1 drug in the US, Humira, with $20 billion in annual revenue — will buy Botox manufacturer Allergan for $63 billion.

Sales

- Hardin Medical Center (TN) will implement Cerner at a cost of $4.2 million, replacing Medhost, T-System, and Allscripts.

- Delta Regional Medical Center (MS) selects PatientMatters IntelliGuide to connect uninsured patients with available healthcare benefits.

- CommonWell Health Alliance signs a six-year contract with Change Healthcare to provide record locator and document retrieval services, extending their previous five-year relationship.

Announcements and Implementations

KLAS names Navigant as the #1 “would you buy again” revenue cycle outsourcer, while Cerner finished by far the worst, with 70% of its customers saying they wouldn’t sign up again. Navigant also finished first in the scope of services offered.

ActX offers 23andMe customers a $95 professional interpretation of their genetic screening results and will screen physician drug orders via EHR integration. The company’s founder, chairman, and CEO is Andrew Ury, MD, who founded Practice Partner, an EHR/PM vendor that was acquired by McKesson in 2007. Seattle-based ActX has raised $3.9 million in seed and venture funding rounds.

UNC Health Care launches an American Well-powered, Epic-integrated telehealth solution that allows existing UNC Health Care patients to schedule video visits from MyChart that the provider conducts within the Epic environment.

Williamson Memorial Hospital (WV) goes live with Meditech as a Service.

JD Power will publish its first telehealth satisfaction study later this year, dividing the market into direct-to-consumer, payer-owned, and health system-owned services.

Government and Politics

The White House’s executive order on healthcare provider price transparency raises some interesting reactions:

- President Trump predicts that healthcare prices will come “way, way down” as “we’re giving that power back to patients.”

- Experts say the order, which has no law behind it pending further rule-making, doesn’t say specifically what hospitals and insurers will be required to disclose.

- CMS Administrator Seema Verma rejects the notion that the order is vague, saying that it specifically mentions disclosure of confidential negotiated payment rates.

- Hospital executives say patients don’t pay the negotiated rates themselves and won’t help those patients make decisions, especially in emergent situations, also noting that previous price transparency efforts haven’t helped patients shop around or save money.

- Employers may benefit since they don’t see individual provider pricing now — the information could help them steer employees to more cost-effective ones.

- Economists note that price transparency could actually drive costs up, citing a much-loved 1990s example in which the government of Denmark forced concrete suppliers to disclose their negotiated prices in hopes of spurring competition, after which those companies were able to raise prices simultaneously since they then knew what everybody else was charging and they had little fear of new competition because of the high barrier to entry.

Other

In Australia, Queensland Health’s director-general – the equivalent of CEO of the 90,000-employee state public health system — will resign following highly publicized cost and patient safety problems with its $1 billion Cerner implementation. Audio recordings of an internal meeting that were leaked two weeks ago caught Michael Walsh saying that he was forced to make positive public comments about the “messy” project in which delays were introduced after clinicians express concerns about patient safety.

IT employees of Regional Medical Center (IA) trigger a state investigation by reporting emails from which they learned that the hospital’s CEO and development director were passing off personal trips as hospital business to obtain expense reimbursement. Investigators found $255,000 in questionable payments, noting the CEO’s 566 “improper” trips and 267 “unsupported” ones. The development director was fired, the CEO resigned four days later, and both have been charged with first-degree theft.

California’s City of Hope cancer treatment and research center will spend $1 billion to build an Irvine, CA campus, two hours from its main location in Duarte.

HIMSS cites a “leadership change” in explaining why it is vacating Cleveland’s Global Center for Health Innovation, where it is the anchor tenant occupying 30,000 square feet. HIMSS had extended its lease in October 2018 for three years. The HIMMS [sic] information page says the Cleveland building is “the perfect location for HIMSS to strive towards their mission to better health through information and technology.”

Sponsor Updates

- The Boston business paper names Definitive Healthcare as the “#1 Best Place to Work” among large companies in Massachusetts.

- Optimum Healthcare IT releases a mobile version of its Skillmarket platform that matches its consultants with upcoming projects.

- Apixio will exhibit at Qualipalooza June 27-28 in Orlando.

- Avaya publishes a new white paper, “AI: The De Facto for Contact Center Experience.”

- Black Book publishes the top 12 highly-rated RCM analytics solutions vendors ranked on 18 key performance indicators in Q2 2019.

- Boston Software Systems names Linda Stotsky marketing content manager.

- CoverMyMeds will exhibit at McKesson IdeaShare June 26-30 in Orlando.

Blog Posts

- A little extra help during pregnancy for moms-to-be (EClinicalWorks)

- A look at ‘governance effectiveness’ in hospitals and health systems today (Advisory Board)

- Here’s What You Need to Know About the Trusted Exchange Framework and Common Agreement (Audacious Inquiry)

- How Can Alternative Payment Models Help to Improve Population Health? (Arcadia)

- What is Your Growth Strategy for Your Ever-Growing Storage Needs? (Atlantic.Net)

- Driving Planned Expansion of AI Across Your Enterprise (Avaya)

- Using natural language processing to manage healthcare records (SyTrue)

- Bluetree raises over $15,000 at 2nd Annual Give Auction (Bluetree)

- Diving Deeper into CMS’ Interoperability Proposal: Enhancing ADT Data (CarePort Health)

- Tablet-based Expanded Pain Assessment Reveals Severe Flares and End-of-Dose Pain at Home (Carevive Systems)

- Internet Trends 2019: How Tech Companies Are Creating the Future of Healthcare (Collective Medical)

Contacts

Mr. H, Lorre, Jenn, Dr. Jayne.

Get HIStalk updates. Send news or rumors.

Contact us.

From my reading of Change Healthcare’s filing, they mostly make their money from EDI and sending people bills in the mail. Is that correct?

Their actual software revenue seems to be smaller and lower margin. That doesn’t seem good as software is supposed to be high margin and they will have a lot of future competition from EHR vendors on the provider side and payers’ own IT staff/Optum et al on the financial side.

I also laughed when Change’s IPO document said that they expected to increase their margin for their bill sending service when healthcare systems switched to sending bills electronically. Like health systems are going to say “Sure, we’ll keep paying for postage even if you’re emailing our bills out now. It’s fine, keep the money, we don’t need it.”

Mr. H is correct regarding the Change Healthcare IPO. They went through 3 RIFs in FY19 alone. One was a complete take down and restructure of account management structure. McKesson has long been known for moving the deck chairs around and it appears CHC has picked up that habit.

My experience with pre-IPO companies is also that they cut lots of employees. I don’t know what the reasoning is for that or if it applies to Change Healthcare.

It’s classic short term Wall Street thinking. Less staff = higher profits, makes company more attractive, sell more stock at higher price. It is very short term thinking, but then the execs that did it will usually hit the road not long after and leave the new folks to ‘solve’ the problem. What is amazing is that the business experts on Wall Street haven’t figured this out after 100 years. Or maybe they have…take the pretty picture, pump the stock, then dump the stock on the public, make big bucks and move on. There’s a sucker born everyday.