RE: Change HC/RansomHub, now that the data is for sale, what is the federal govt. or DOD doing to protect…

News 7/31/15

Top News

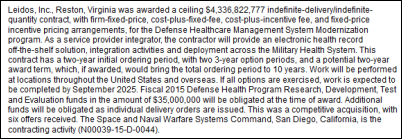

The Department of Defense awards a $4.3 billion renewable EHR contract to the team of Leidos, Accenture, Cerner, Henry Schein, and 31 partner companies, with the DoD estimating its total project cost at $9 billion over 18 years. The roster of companies in the Leidos Partnership for Defense Health includes:

3M

Accenture

Apex Systems

Aderas

ASM Research

Athena Consulting Group

Blue Ridge Federal Consulting

Bridgemore Concepts

Cambridge International Systems

Cerner

Clinovations Government Health

Cognitive Medical Systems

CWS

Ecco Select

EHR Total Solutions

Enterprise Management Systems

Exact Data

Henry Schein

Holland Square Group

HP

ICSA Labs

Intellitronics

Iris Partners

Leidos

ManTech

MBC

MedPro Techologies

MedRed

Medsys Group

NetVision Resources

Ocean Bay Information & Systems Management

ProSource360

SAIC

Security Risk Solutions

Spin Systems

Tiag

Universal Consulting Services

Valytics

Most interesting of these subcontractors is the apparently defunct Ocean Bay Information & Systems Management LLC, launched in April 2012 in Alaska and shut down in December 2014 without an online trace. Its founder, Ernest Anastos, lists his current occupation as “versatile executive seeking new challenges.” The meaty part of his bio is further down the page: he was a former CEO of the Navy Medical Information Management Center and handled Navy acquisitions (DHMSM is a Navy project).

Reader Comments

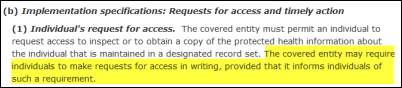

From HIPAA Love: “Re: requiring a signature on patient information requests. It’s not a HIPAA requirement, but HIPAA allows covered entities to require individuals to make their requests in writing as long as it tells them so.” Thanks. That means hospitals and practices that require patients to fax or mail a signed request form are just making their own rule, not enforcing a HIPAA requirement.

From Denominator: “Re: former Epic employees. Profiled on a Madison site.” The article describes a few former Epic project managers and implementation consultants who struck out on their own after growing tired of endless travel, long hours, and lack of personal satisfaction. They twenty-somethings report changing jobs to fulfill their true passions despite walking away from an average Epic salary of $83,000.

From Red Man Walking: “Re: companies and CEOs. Which ones have you advised or worked with?” None. My life’s work seems to be sitting in an empty room filling an empty screen every single day, but perhaps I’m missing an opportunity to become a “Consigliere to the CEO Stars,” where I would serve as the invisible, ambition-free, bias-free source of truth for CEOs who don’t trust their ambitious, biased VPs to challenge their decisions, provide brutally honest advice, or provide a spin-free assessment of what customers and the market are saying. I like to think that my complete lack of qualifications (having never run a business or climbed the executive ladder) is offset by my naive objectivity and lack of a socially acceptable verbal filter.

From Festus: “Re: BJC HealthCare. Experienced a system-wide computer outage this week.” The St. Louis-based system goes down for 20 hours through Wednesday morning, leaving its 13 hospitals with no access to its EHR, administrative systems, and email. The hospitals went back to paper and turned away transfer patients. BJC hasn’t announced the cause, although with all systems down you would have to assume network problems or maybe even a malware attack since otherwise I would expect the hospital to have diagnosed and announced what went wrong.

HIStalk Announcements and Requests

You may have noticed that you couldn’t bring up the HIStalk page for part of Wednesday afternoon. So many readers were looking for DoD news that my web hosting provider initially thought it was a denial of service attack. Even though the site couldn’t handle all the readers with the server’s CPU usage needle pegged, it still received 16,000 page views in 12,000 unique visits Wednesday, which I’m pretty sure is a record. I’m writing this Thursday evening and today’s numbers are tracking just about as high. A couple of people emailed me to say that I should start a DoD EHR site, although I think interest will wane as the hard work goes underground and there’s not much to talk about for a year or two.

Here’s a shout-out to Carla from Health Data Specialists, who asked for a “we sponsor HIStalk” website badge since they are fans. I didn’t give much direction to the offshore guy to whom I paid $15 to design the graphic figuring it wasn’t all that important, but Carla was right – dozens of sponsors have asked for it for their own sites after I mentioned it in my email to them. It’s gratifying to be supported so enthusiastically.

This week on HIStalk Connect: Nike and Apple settle a class-action lawsuit alleging that the companies knowingly marketed FuelBand activity trackers as more accurate than they actually are. German engineers develop a prosthetic hand capable of mimicking details muscle memory functions. AstraZeneca partners with Adherium, a New Zealand based digital health company that makes smartphone-connected inhalers to help COPD and Asthma patients track medication adherence. Illinois amends its blue sky laws to allow startups to run equity-backed crowdfunding campaigns worth up to $4 million.

My Medical Records Saga Continues

Add to my list of ways providers can make patient electronic records requests easier by sending me your ideas. Here’s one I received:

Provide several ways for patients to request them. Over the phone, online, patient portal, etc. Ensure that in order to receive the records, patient needs to provide several key identifiers that ensure the information is secure and is only provided to said patient (or patient POA). Have a dedicated person and/or department handle these requests so that there is an efficient process and patients don’t have to wait to receive information that is rightfully theirs.

Thoughts on the DoD’s selection of Leidos, Cerner, Accenture, and Henry Schein

- The DoD notified the bidders of its decision early Wednesday morning but asked them not to comment until after its contract announcement, which was posted online at just after 5:00 p.m. Eastern time. Analysts for the publicly traded participants apparently started leaking the news at between 3:00 and 3:30, giving shares of Cerner and Leidos a sharp rise on high volume by around 3:30.

- This was not a typical EHR procurement given that the package includes a lot more than just a single product. It wasn’t just Allscripts, Cerner, and Epic that were being evaluated, but rather an extensive package of services, infrastructure, maintenance, and willingness to meet the DoD’s ongoing needs. It would be interesting to know how much of the final scoring involved the actual EHR product and vendor.

- Self-proclaimed experts lauded the decision in suggesting that “openness” played a part even though: (a) they didn’t define “open”; (b) they didn’t say how they determined that Cerner is more open than Epic or Allscripts; and (c) DoD didn’t say how (or if) it measured and scored “openness.”

- Most of the industry – me included – underestimated the importance of the military’s comfort level with the prime contractor based on what knowledgeable readers have told me since the bid was announced. I’ve heard that IBM isn’t strong in defense contracting compared to the winning consortium’s defense powerhouse of Leidos, Accenture, and SAIC.

- Allscripts had one good partner (HP) and one not-so-good one (CSC) and a product with tiny market share and limited breadth, making that team the obvious long shot no matter how you look at it. Clearly nobody expected the Allscripts group to win given that MDRX shares didn’t drop on the news that it lost.

- Accenture’s participation may have tipped the scales slightly for Leidos since it helped save Healthcare.gov.

- The DoD says it has spent more time on the EHR project so far than it did on the trillion-dollar F-35 Joint Strike Fighter.

- Leidos operated as SAIC until it spun that unit off as a separate business and renamed itself Leidos in September 2013. SAIC has outperformed Leidos on the stock market in the past year, with its shares up 28 percent compared to those of Leidos at 6.5 percent.

- Cerner will replace the military’s present system, the many-billion dollar, contractor-enriching, VA-ignoring, custom-written taxpayer boondoggle known as AHLTA.

- Cerner did not win the bid, Leidos did. It’s an important distinction since Cerner is not accustomed to taking a second banana position. Cerner as a company is worth nearly nine times the stock market value of Leidos. Even Henry Schein is four times larger than Leidos.

- I’ve heard rumors that Leidos won the bid mostly on price and DoD comments seem to reflect that. The company needed good news after recent major business problems (huge losses, CEO replacement, and a big drop in its healthcare business) and may have bid aggressively for that reason.

- I’ve also heard that a lot of the $4.3 billion initial contract value (more than half, in fact) isn’t guaranteed, but rather is set up as contingency money. Leidos and its partners excel at extracting money from the often clueless Washington bureaucracy, a capability that will be essential if the contract really does put so much of the contract value at risk. The #1 rule of government software project bidders: put in a lowball bid knowing that once you get your foot in the door, you can figure out ways to enrich the deal.

- If indeed so much of the contract is at risk, that leaves Leidos and its 34 partners with maybe $2 billion guaranteed over 10 years before extensions, which includes all costs related to implementation, support, and software maintenance. Leidos as the prime contractor will certainly be squeezing its subs (including Cerner) to keep as much of the money for itself as it can.

- I don’t know how much Cerner gets from the total project award, but a SWAG might place it at 10-20 percent. If only $2 billion or so is guaranteed, maybe Cerner gets $200-$400 million guaranteed over 10 years (obviously I don’t have insider information so this is just speculation for entertainment’s sake). If that’s anywhere close, $40 million per year isn’t going to change Cerner’s life all that much given that it’s already tracking close to $4 billion in annual revenue.

- One-third of the non-software cost has to be subbed out to small, minority, or veteran-owned businesses. That means Leidos will have to contract out quite a bit of even the software maintenance fees. Check the list I posted at the top of the page – many of the companies partnering with Leidos trumpet their set-aside status more than anything else.

- Cerner tagged Intermountain as a “strategic partner” that will provide “clinical governance of solutions and workflow,” although I don’t understand what battlefield and military hospital expertise Intermountain brings to the table.

- Cerner and Leidos are going to need a bunch of experienced project people, and in the absence of restrictive policies like Epic’s that prevent experienced people from moving on to better jobs with other hospitals or consulting firms, the poaching is probably already underway.

- The contract has a first-year budget of $149 million and an expected total lifetime cost of $9 billion over the next 18 years (keep an eye on that estimate because you won’t see it that low again).

- Let’s not forget that Henry Schein was a big winner, too, as one of the four winning core partners in contributing its dental system expertise.

- I can’t imagine that the Epic and Allscripts teams will fight the DoD’s decision barring some major contracting gaffe, but it does bring back memories of the then-tanking, Tullman-led Allscripts throwing a lawsuit tantrum when New York City Health and Hospitals chose Epic over Allscripts in 2012, when Allscripts cried that it wasn’t fair that their prospect was willing to pay more to get Epic.

- It’s hard to predict how each company will fare now that the die has been cast. Will Cerner gain knowledge and experience that it can roll into products for the general market or will DoD consume so much of its energy that it will get distracted? Will Epic lose prestige and sales now that it has lost the biggest procurement in health IT history or will it bear down harder in competing with Cerner? Does Allscripts keep trying with Sunrise or just concede the hospital EHR market and focus on ambulatory systems and population health? Do existing customers of each vendor win or lose?

- It’s good for the market that Cerner won since Epic needs more competition, although it’s a shame that we don’t have a strong third competitor.

- I remember the excitement when companies won those big NPfIT contracts years ago and it turned out to be a bloodbath for them when they were held accountable for delivering what they promised. Let’s hope (against hope) this project delivers more than a spectacular NPfIT bonfire of British pounds. Big government IT projects hardly ever hit their planned budget, timeline, and benefits, but contractors and taxpayers keep lining up at the trough to take another swing.

Speaking of the DoD, it’s a good time to re-watch Dim-Sum’s September 2014 HIStalk webinar titled “DHMSM 101: The Hopes, Politics, and Players of the DoD’s $11 Billion EHR Project,” which has been viewed a couple of thousand times on YouTube. Spoiler: Leidos wins at the end.

Webinars

None scheduled in the next two weeks. Previous webinars are on the YouTube channel. Contact Lorre for webinar services including discounts for signing up by Labor Day.

Here’s a just-completed (and outstanding) webinar titled “Earning Medicare’s New Chronic Care Management Payments: Five Steps to Take Now.”

We also just finished “De-Silo Your Disparate IT Systems Around the Patient with VNA” by Lexmark.

Acquisitions, Funding, Business, and Stock

McKesson reports Q1 results: revenue up 9 percent, adjusted EPS $3.14 vs. $2.47, beating analyst expectations for both. Technology Solutions revenue was down 7 percent due to the company’s anticipated drop-off in hospital IT business and the sale of its nurse triage operation, but tempered by good performance from RelayHealth and the physician revenue cycle business. CEO John Hammergren said in the earnings call that, “We have been struggling in the hospital IT business, where we have been reinvesting in the go-forward products and de-investing in the products that we’ve already announced that we plan to sunset” as the company tries to “put the momentum back in the business.”

CVS Health will co-develop a chronic disease care management solution with IBM’s Watson group, planning to sell it to insurers and use it in its own pharmacies and MinuteClinics.

MedAssets reports Q2 results: revenue up 13 percent, adjusted EPS $0.31 vs. $0.30, beating expectations for both.

Lockeed Martin exhibits atrocious timing in announcing its Healthcare Technology Alliance the day Leidos and Accenture hogged the government contractor limelight with the DoD’s announcement, but if anyone cares, the Alliance’s founding members are Cisco, Cloudera, Illumina, Intel, and Montgomery College.

People

Stephanie Wallace (Greythorn Healthcare IT) joins Huntzinger Management Group as national sales director.

Cumberland Consulting Group promotes Praneet Nirmul and Adam Seyb to partner.

Margaret Laws (California HealthCare Foundation) is named president and CEO of HopeLab, which develops children’s health-related technology.

Valence Health names former TriZetto and Eclipsys CEO Andy Eckert as CEO. Founding CEO Phil Kamp will move into a chief strategy officer role. Eckert is chairman of Varian Medical Systems.

Announcements and Implementations

John Gomez (Sensato) and Colin Konschak (Divurgent) publish “Cyber-Security in Healthcare 2015,” available as a free e-book download from iTunes.

Government and Politics

Rep. Renee Ellmers (R-NC) introduces the Flex-IT 2 act that would delay Meaningful Use Stage 3 until at least 2017. CHIME chimes in with its support for the bill, saying it will ensure Meaningful Use’s “long-term vitality,” meaning it likes the EHR welfare program as long as the provider bar is set low enough that everybody collects taxpayer cash, not really buying into the idea that the MU program was supposed to be a short-term, cash-for-clunkers stimulus project.

Privacy and Security

Partners HealthCare-owned McLean Hospital loses four unencrypted backup tapes containing information on 12,600 people who have designated their brains to be donated upon their death.

Other

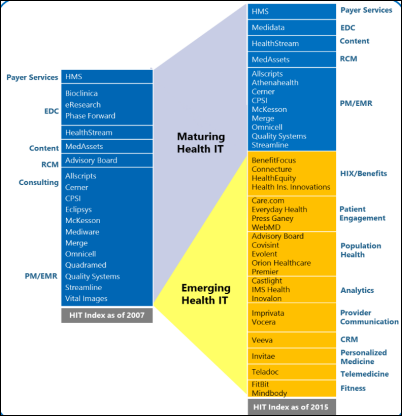

Healthcare Growth Partners publishes its mid-year health IT review with a focus on IPOs. I can’t say enough about HGP’s reports – they are stellar at summarizing the challenges and opportunities of healthcare and healthcare IT in a macroeconomic way. HGP gives their reports away when other firms produce reports with a tiny fraction of their insight and charge handsomely for them. The graphic above nicely compares the 2007 publicly traded health IT market to that of 2015. I also enjoyed this brilliant summary of US healthcare:

Healthcare spending in the US is about 90 percent higher than in most other industrialized countries. The US ranks #46 out of 48 in terms of efficiency – one place below Iran, and that’s without economic sanctions. Inefficient markets typically result in a mispricing of goods and services. The cause is often due to monopolies, poor regulation, and a lack of market transparency. Each is a contributor to inefficiency in the US healthcare economy, but the primary shortcoming is the lack of market transparency, or information, needed to define the cost and quality of goods and services, otherwise known as value. Restated, we must define the cost of care and we must define the quality of care in order to determine the value of care. That information then must be made available to consumers who can act on it to create a market-based economy, which in turn theoretically leads to outcomes and efficiencies. The concept of “value” is behind nearly all health IT investment activity, and in a market as personalized and complex as healthcare, the amount of investment required to achieve it is staggering.

Four hospital ED nurses in Saudi Arabia face prosecution for causing injuries that require a six-year-old’s hand to be amputated after their failed attempt to start an IV.

HIMSS is attempting to insert itself into the DoD’s EHR project by announcing how happy it will be if someone will just invite it to participate, so I will issue an equally self-serving statement of my own:

As the Department of Defense moves forward with its modernization project, Mr. HIStalk is committed to working closely with the DoD on the planning and implementation stages in providing biting commentary for those involved.

Weird News Andy applies his own product name of “iDon’t Touch” to iSperm, which turns an iPad into a sperm counter. WNA also likes this story about nice Canadians (he says the term is redundant) in which a woman stuck in the ED with her sick child posts her status to a Facebook new moms group worrying about her car being towed, after which several strangers feed the parking meter until she is able to leave. WNA pipes up one more time to comment on the CVS-IBM Watson story, titling it, “Come here, Watson, I need you” in picturing a CVS customer answering Watson’s questions about intestinal distress with, “Alimentary, my dear Watson.”

Sponsor Updates

- An independent analyst firm places VisionWare among the leaders in master data management technology and customer satisfaction.

- A Validic survey finds that 59 percent of healthcare respondents are either behind on their digital strategy or don’t have one.

Contacts

Mr. H, Lorre, Jennifer, Dr. Jayne, Dr. Gregg, Lt. Dan.

More news: HIStalk Practice, HIStalk Connect.

Get HIStalk updates.

Contact us or send news tips online.

Re: HIStalk Announcements and Requests/DHMSM page: Maybe you could create a Federal Government page for DoD and VA news? As a Federal Contractor, I like seeing that market covered in your daily update.

Thanks!