Health IT from the Investor’s Chair 11/28/22

HLTH 2022 – Party Like It’s 1999/2019!

First, I hope Mr. HIStalk and all readers will accept my apologies for my delay in writing this. I came home from HLTH with my first case of COVID-19 and it has taken some time to regain focus.

Which brings me to my first observation. HLTH 2022 had absolutely zero COVID-related safety protocols! Where last year’s conference — and the two Health Evolution Summit events that I attended since COVID became a thing — required both proof of vaccination and a negative antibody test, the HLTH organizers opted to eliminate both requirements this year. That’s a profound disappointment for a healthcare conference. I had heard that even the adjacent cannabis conference was mandating vax cards.

I would estimate fewer than one mask in 250 attendees, and I’m truly embarrassed to say that I, too partied like it was 2019 and doffed both mask and caution for the first time since March 2020, with sadly predictable results. I hope all who were exposed and their friends and families are not too seriously impacted and are recovering well.

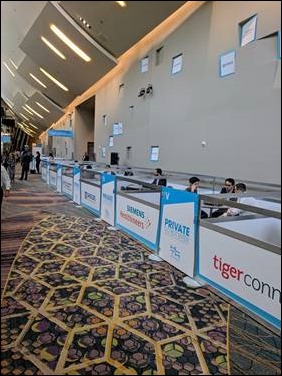

Moving on. I think that for most attendees (although this could be sample bias), HLTH is all about networking, or, as the event organizers might call it, “convening.” HLTH does nothing if not excel at helping there. The seemingly limitless conversation spaces is always fantastic. Sharing a ride to the hotel with colleagues who I ran into on the plane and then running into both a former client and another long-term industry colleague as I first entered the hotel were just the first of the many synchronicities HLTH helped promote.

It was undeniably great to be back at a conference with both planned and random meetings. Biggest coincidence? I received a text message from a client thanking me for setting up a great investor meeting and, as I was reading it while walking the floor, I got stopped by the other person in the meeting telling me how impressed he was by the company!

As a friend noted, HLTH is the cooler cousin of HIMSS, and I think that is an apt description. In my 20+ years of HIMSS attendance, I’ve noticed that few show up with checkbook. In the case of HLTH, I’m confident that the only folks who are there to spend organizational money on anything but attendance are investors and strategic buyers who are looking to deploy capital on shiny new concepts. As he always does, Jonathan Bush said it better than I ever could – “If HIMSS was the boat show, HLTH is the dog park. Everyone is going around sniffing each other’s butts.” I was glad the HLTH puppy park was back, though.

That said, I’m not sure if it was a Vegas versus Boston phenomenon, but I, along with many others I spoke to, found the event to be over the top in ways that felt, in one colleague’s words, tone deaf. “With hospitals understaffed and losing money, a healthcare conference spending $300K on a rap concert and another $100K to platform a disgraced athlete is questionable,” he pointed out. Where Boston’s HLTH had a five-foot disco ball to meet under, this year there was what seemed to be a 20-foot giant moon in a room where people seemed to be napping.

Santayana famously said, “Those who cannot remember the past are doomed to repeat it,” but it is also said, “Those who understand history are condemned to watch others repeat it.” Having participated in the dotcom boom/bust as an equity analyst, I saw all too many similarities. Changing the paradigm? Check. This time it’s different? Check. Silly exhibit concepts? Oh my word, yes! Party ending with rising interest rates and high profile explosions? Looks like! Yes, valuations remain at relatively historical highs, but I anticipate another cycle before we see the excesses in expectations, self congratulations, and valuations as this HLTH sadly typified.

Now this could be the ramblings of a cranky — and, did I mention, COVID-positive – Gen Xer, but I checked in with one or two hipper proteges in their 30s and got fairly similar reactions “Optum lobby felt like Times Square” and “too much overstimulation.” A VC friend bemoaned the number of mature-enough companies to fit her investment parameters as well as concurring on the dearth of potential customers.

As I shared in my post on the first HLTH, the conference is based on the founders’ proven success formulas and is backed by leading healthcare investor, Oak HC/FT. A VC colleague I ran into said it might prove to be the best health tech investment made in the last few years. While I wouldn’t go quite that far, I do predict it will be in the top decile. Whether it should be is another question, as its value to companies, investors (and me) is clear, but to patients, not so much.

One final question bandied about – will this replace JPMorgan, at least for health tech? I predict that it will not. Vegas is easier, drier, and cleaner (other than the ubiquitous cigarette smoke), but IMHO and based on more than a few conversations and party invitations already sent and received, the JPMorgan conference is too much of a tradition and too ingrained to fall by the wayside. Oh, and it is transparently, not obliquely, focused on investors.

Ben Rooks has now attended every (non-virtual) HLTH, 26 HIMSS, 12 Health Evolution Summits, and JPMorgans as far back as its H&Q Days. He’s also been proud to write this column for HIStalk for over a decade, albeit not often enough, so feel free to email him questions or ideas for future installments. He also really enjoys his day job at ST Advisors.

A couple of years ago I had a conversation with one of my physician colleagues about how EHRs and MU…