Sounds reasonable, until you look at the Silicon Valley experience. Silicon Valley grew like a weed precisely because employees could…

Monday Morning Update 8/29/16

Top News

Promedica (OH) attributes its first-half 2016 losses to the cost of its Epic implementation. The 12-hospital health system swung from a $43 million operating surplus in the first half of 2015 to a $2 million loss in the same period of 2016. Higher employee costs also contributed.

University of Texas says M.D. Anderson Cancer Center’s 77 percent drop in net income (down $405 million) in the past 10 months was due to higher expenses and reduced patient revenue, both resulting from its implementation of Epic. MDACC went live on Epic in March 2016 and says it anticipated the negative financial impact, but hopes to “return to normalized operations by year-end.”

Reader Comments

From Carl Kolchak: “Re: Suburban Hospital (part of Johns Hopkins). My father is a patient there and the whole Epic system was down. They are on downtime procedures, which is interesting to watch.” Unverified.

HIStalk Announcements and Requests

More than 80 percent of poll respondents think hospitals should be required to bill uninsured patients at the lowest prices they offer to insurers or anyone else. Sally B says it’s just plain wrong that those who can least afford it are expected to pay the most, while Mind Blown offers personal experience of an $85,000 hospital stay that his or her insurance company negotiated down to $16,000, something the average person wouldn’t have been able to do. Ron is encouraged that local health systems are offering big upfront discounts for elective procedures, although they take a long time to return calls. Mindy also has personal experience, in her case a $2,400 CT scan that despite not having hit her insurance deductible, cost her only $808 thanks to her insurer’s negotiated price. Nick says a benefit of forcing hospitals and health companies to offer everyone the same rates they accept from big insurers would be the creation of a price book that would allow people to comparison shop.

New poll to your right or here: who is most responsible for high US healthcare costs?

Last Week’s Most Interesting News

- In Canada, grocery and drug store operator Loblaw offers $132 million for EHR vendor QHR Technologies, which holds 20 percent of that market in Canada.

- Fast Company discovers that Apple acquired consumer EHR data collection and sharing startup Gliimpse earlier this year.

- CommonWell Health Alliance adds patient-facing services that several vendors have committed to incorporating into their EHRs.

- The Office for Civil Rights announces that it will expand its investigations into data breaches involving the information of fewer than 500 people.

- Canada-based Harris acquires OB/GYN EHR/PM vendor DigiChart.

Webinars

None scheduled soon. Contact Lorre for webinar services. Past webinars are on our HIStalk webinars YouTube channel. Some recent ones that are available for replay:

- Surviving the OCR Cybersecurity & Privacy Pre-Audit

- Your Call is Very Important

- Ransomware in Healthcare: Tactics, Techniques, and Response

- rise of the small first letter vendors

- Six Communication Best Practices for Reducing Readmissions and Capturing TCM Revenue

Acquisitions, Funding, Business, and Stock

Verisk Health renames itself to Verscend Technologies. Veritas Capital acquired the now-independent business from parent company Verisk Analytics in April 2016. The company hired Emad Rizk, MD (Accretive Health) as CEO and board director two weeks ago.

People

Scott Newton, DNP, RN (The Johns Hopkins Hospital) joins TeleTracking as VP of care model solutions.

Lisa Elias (Leidos) joins Orchestrate Healthcare as area VP.

Announcements and Implementations

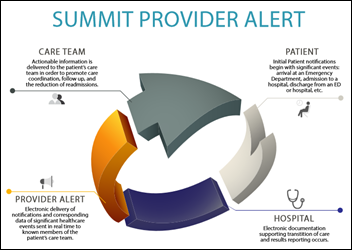

Summit Healthcare launches Provider Alert, which allows hospitals to send electronic notifications and documents to physicians whose patients have been treated in the hospital. Parkview Medical Center (CO) will implement it.

In England, Yeovil District Hospital NHS Foundation Trust goes live on InterSystems TrackCare.

Government and Politics

NIST’s National Strategy for Trusted Identities in Cyberspace funds six new pilot projects that include a $1 million grant to Cedars-Sinai Medical Center (CA) to implement single sign-on and two-factor authentication for both patients and providers to simplify transition to post-acute care settings. The project was awarded in partnership with ONC.

Technology

Vital Images is exploring the use of Microsoft’s HoloLens in its enterprise visualization solution, with use cases that include guided surgery and education, telemedicine, and virtual care.

Business Insider covers the problems DocGraph and its CEO Fred Trotter had last week when Google automatically shut down the company’s access to its storage and analysis services due to suspected hacker activity, which turned out to be justified because the company’s misconfigured server had allowed a hacker to use it to launch denial-of-service attacks. Experts say Google’s cloud services are immature compared to those of competitors such as Amazon, to which Trotter has turned as a backup in case Google’s cloud becomes unavailable again.

A photo of Donald Trump’s doctor – who admits that he spent only five minutes dashing off a bizarre, hyperbolic assessment of the health of the candidate, who has not released his actual medical records — apparently uses a Windows XP computer in his office, based on video from NBC.

Other

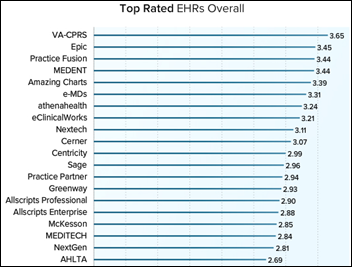

Medscape’s 2016 physician EHR survey finds some interesting facts:

- Epic is by far the most widely used EHR, beating out Cerner 28 percent to 10 percent.

- Allscripts, which came in at #2 most used in the 2012 survey, didn’t even place in the top five this time.

- The top-rated EHR is the VA’s VistA, beating Epic. The lowest-rated is another government system, the DoD’s multi-billion dollar AHLTA.

- Hospital-based and independent practice doctors both rate NextGen as the worst system.

- The highest-rated EHRs for satisfaction are Practice Fusion, Amazing Charts, and VistA.

- VistA and Epic lead the pack for connectivity, while Amazing Charts, Greenway, Practice Partner, and NextGen hold the bottom four spots.

- Half of the respondents say the EHR takes away from their face time with patients and reduces the number of patients they can see.

- Forty-two percent of doctors say they copy and paste EHR information “often” or “always.”

Maybe some vendors are closer to becoming “the Uber of healthcare” than they think: Uber has lost at least $1.2 billion so far this year. A business professor who questions Uber’s high valuation summarizes, “You won’t find too many technology companies that could lose this much money this quickly. For a private business to raise as much capital as Uber has been able to is unprecedented.”

A Milwaukee Brewers fan blogger proposes that Epic CEO Judy Faulkner offer to move the team’s AAA affiliate from Colorado Springs, CO to Verona, WI and building it an indoor stadium that could also be used for Epic meetings. Otherwise, the Sky Sox are headed to San Antonio in 2019 if the owner can convince city taxpayers to buy him a stadium. Cerner’s Neal Patterson has his soccer team, so it would be fun for Epic to have its own baseball team.

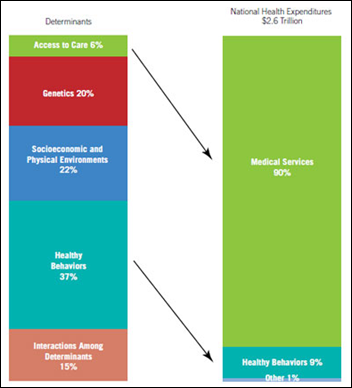

This brilliant graphic tells you everything you need to know about why our absurdly high US healthcare costs involve throwing money at the wrong (but highly profitable) health determinants. That tiny patch of green on the left shows how little the delivery of healthcare services influences overall health despite what hospitals and practices would have you believe. That hugely dominant patch of aptly colored green on the right shows that, like bank robber Willie Sutton, profit-seekers have gone where the money is (hint: it’s not in prevention or teaching people better lifestyle habits). “Healthcare” is not even vaguely synonymous with “health.” You also can’t have “public health” when the public in question would rather fund hospital bills than self-examine their eating, drinking, smoking, drug-taking, and exercise habits.

In Ireland, several dozen job candidates who had been offered positions with GE Healthcare are talking to lawyers after the company rescinds all of its job offers the day before the new hires were scheduled to start work. Some of them are now unemployed since they had quit their old job. The company says its labor unions are at fault for balking at its plans to change work schedules.

Vince and Elise continue their “Rating the Ratings” series. They subjectively rank the 1-2-3 finishers among KLAS, Black Book, and Peer60 using criteria they describe.

Weird News Andy notes the death of man whose but often-played but never-cleaned bagpipes infect his lungs with fungi that cause hypersensitivity pneumonitis. WNA puts an upbeat spin on the story with his favorite bagpipe jokes:

- What is perfect pitch with bagpipes? 20 yards into a lake.

- What is the difference between bagpipes and a lawn mower? You can tune a lawnmower.

- What is the difference between bagpipes and a trampoline? You take off your shoes to jump on a trampoline.

Sponsor Updates

- Experian Health and The SSI Group will exhibit at CAHAM August 28-31 in La Jolla, CA.

- Christus Trinity Mother Frances Health System CIO Mike Eckhard discusses its use of PatientSafe smart phones on the local news.

- WRAL Tech Wire interviews PatientPay CEO Tom Furr.

- Network World interviews Red Hat CEO Jim Whitehurst.

- The local business paper covers GE Healthcare’s donation of medical equipment to the Olympic and Paralympic games in Rio.

Blog Posts

- What the Future Looked Like a Week Ago – Hopey, Feary, Changey Edition (CloudWave)

- Navigating the Rivers of Processing Patient Payments (and the Chattooga) (Patientco)

- The Impact of Inaccurate Provider Data on the Shift to Value-Based Care (Phynd Technologies)

- Seeking Paragon (PMD)

- Sagacious Teams Up with Tri 4 Schools for UGM 2016 Fundraiser (Sagacious Consultants)

- Quality is the New Revenue – So Measure and Act (Streamline Health)

- Driving the Digital Shift in Healthcare (Surescripts)

- Top C-suite Misconceptions About Disaster Recovery Services (Tierpoint)

- New devices + powerful apps = an ideal option for hospital staff. (Voalte)

- 4 Customer Service Lessons Starbucks Can Teach Retail Pharmacies (West Corp.)

Contacts

Mr. H, Lorre, Jennifer, Dr. Jayne, Lt. Dan.

More news: HIStalk Practice, HIStalk Connect.

Get HIStalk updates. Send news or rumors.

Contact us.

If you are not offered a “cash” price at the prescription counter, there may be a good profit reason as to why not. Pharmacists are not allowed to offer you a cash price “unless you ask” so be sure to ask as all the PBM software analytics are plugged into the big pharmacies now that tell the pharmacist what to charge you and in many cases, it’s more than the pharmacy’s cash price. Pharmacists get threatening letters if the PBMs feel they are offering cash prices that hit their profit barrels by telling them they are breaching their contract, i.e. OptumRX has been caught on this one a few times. I keep challenging folks to ask the pharmacist for their “secret” medication adherence prediction score that is created on all of us, but we are not allowed to see.

This is not actual monitoring but is rather about 300 metrics they use besides actual monitoring to “predict” if you will be a good adherent patient. Doctors get those notes too back from Optum/United as well. Dr. Wes, put one up on Twitter a couple weeks ago with an actual screenshot of Optum telling him he might be missing an opportunity to discuss medication adherence as the algos that compute predictions said the patient was less than 80% and that he should entertain a conversation. They were using information from the doctor’s claim files, not EHR data and there’s been many conversations about the accuracy of claims versus EHR data.

http://ducknetweb.blogspot.com/2016/06/the-truth-about-pharmacy-benefit.html

The irony of the prescription coupon cards is that these marketing firms (what they really are) negotiate discounts with the same pharmacy benefit managers that insurers are using, i.e. Express Scripts, OptumRX, Caremark and so on. So if you decide to let’s say pay cash, they can still get your data on prescription adherence predictions this way. Many independent pharmacies will offer you the cash price or will run the coupon through, see what the prices is and match it without running your prescription data through the card so they don’t get the data.

Administrators, insurers, and drug companies are pretty much where the high prices of healthcare is being driven today.

Look at United, their number one revenue stream, ahead of each of their 3 insurance groups (they report 4) is more than each of them. I don’t think many are aware of the fact that United got their start in the 70s as a pharmacy benefit manager before they ever sold insurance. They sold off their original PBM to a drug company, which I think was GSX (don’t quote me for sure on that one) and then the drug company used it for a year so so, and then turned around and sold the original United PBM data framework to Express Scripts, so it appears the same computer code and queries is running in many of the same places for all of this. With the money United made from selling their original PBM, they used the money to buy insurance companies and that’s how they became a health insurer. The drug business is also how Andy Slavitt got started in healthcare when he and Elizabeth Warren’s daugher created a company called HealthyAllies that they sold to United. It is a card you pay $25 a month for to get prescription and care discounts and it’s still out there as a subsidiary today of UHC.

http://ducknetweb.blogspot.com/2016/04/united-healthcare-reports-1st-quarter.html

By far the best explained and most informative write-up I’ve read on the subject of discount cards. I used to get them in my mailbox and dismissed their value. Patients might be better served if they got news like yours, rather than “huge” political gaffes.

#EpicCosts

An epic epidemic of red ink. Patients and their doctors are sacrificing for what, exactly?

One of Promedica’s ChiefXOs joined just before they selected Epic, and was a former Director in Epic’s Client Services division. Someone in an instrumental position to develop Epic’s support model, hardware recommendatons, staffing recommendations, and other factors. Things to keep Epic’s client projects ontime, under budget, and affordable.

A bit surprising to see a project he likely had a huge role in leading now on the customer side operating at such a loss to prior performance. What does that say about Epic’s recommendations?

This Epic red ink argument is quite overblown.

It does take time and effort and Epic recommends slowing down production the weeks right after go live.

Less profit and an occasional partial year dip is more the norm with these projects and likely alot better than the continual bleed out of incremental projects with other vendors.

What we need to focus on is the 1 to 4 year after go live. Looks like Epic sites are doing pretty well in that view.

On the topic of Epic, does it feel to anyone else like HIT news has hit a doldrums since the wave of Epic contract signings has come to an end? It actually feels retro to have articles about go live costs to argue about.

“everything you need to know about why our absurdly high US healthcare costs involve throwing money at the wrong (but highly profitable) health determinants”

LOVE.

Move over trees, we’ve got a forest to explore.

RE: Medscape

Something never seems to add up when these “survey’s” are completed. I have worked in HIT for the last 11 years, with several different systems: Cerner, Epic, eClinicalWorks, etc, and every time I see these survey’s, it always mentions how many more people use Epic and how great VistA is.

So, if VistA is so great, then why has the VA continuously had issues with it and why are they looking at going to market for a commercial system? There is no way, with all of the issues reported with the VA’s HIT system, that you could have a survey that lists it as the #1 Top Rated EMR. Something is not right there.

As for Epic being so much more widely used that Cerner, again, there has to be some flawed logic there….When we look at the largest IDN’s in the US (both for profit and not for profit), Cerner has more of them then Epic Does: Community Health Systems, Tenet, Ascension Health, CHI (50/50 split there), Trinity Health, Dignity Health, Adventist Health, UHS, Banner Health, Intermountain Health (10 or the top 15 based on total staffed beds). So, If Cerner Technically has more of the largest systems in the US, then how does Epic have more use at the numbers provided in the survey (28%-10%). I mean, even if Epic just cleaned up in the Ambulatory Space, which they do have an advantage there, the numbers still wouldn’t add up. Something is flawed with these Surveys…

I am not a Cerner guy or an Epic guy, I think both have their positives and negatives. But, when looking objectively at the data, something just doesn’t add up..

Food for thought on EHRs

What’s the cost to a hospital system should they implement a buggy EHR that causes orders to be applied to the wrong patient?

The answer: if made public that organization would very, very quickly go bankrupt (if it were to happen for a meaningful amount of time).

Worse, I’ve heard two verified situations where this happened with EHR upgrades. Any minor financial impact with Epic is nothing compared to some of the alternatives.

RE: Rating the Ratings: Kudos to Vince and Elise for shining a light on the lack of transparency related to dollars captured by KLAS from vendors, was glad to see that was part of the grading criteria – it absolutely should be.

I somehow doubt Judy cares about minor league baseball

Am I the only one who thinks WNA’s bagpipe jokes are in poor taste given the piper’s demise?

Here’s what is really interesting about all the Epic /cost /loss press releases.

Up till about 2 years ago no Epic client ever would say Epic was the cause of any issue. No matter what. Bad implementation, that’s because we the hospital did not do our homework, software problem, we’ll we mis-configured, etc,,,,

Several years before that we heard the same thing from Cerner clients ( not so much today). But now it seems as soon as there is a financial fall off…Epic made it happen!.

If you want to understand what is really happening go back to my HISTalk article of 1/2/2013 – The Seven Deadly Sins of EHR Success.

http://histalk2.com/2013/01/02/readers-write-1213/

Re: Epic cost

Is it just me, or are all these press releases announcing health organization’s financial statements NOT pretending that the initial cost of implementing Epic is something unexpected? In other words, these are not “issues” as Frank Poggio assumes, just a matter of fact statement of the financial situation for a given quarter.

RE: Epic Costs and Value

A lot of execs publically state that their system will benefit financially from installing Epic, which makes sense for these execs to do in the sales stage, but I have never seen any evidence of tangible financial benefit post live other than one off examples which may not apply to other hospitals.

Can anyone point to an even reasonably rigorous analysis of pre and post live EHR implementation financials which would show that implementing Epic is worth the known substantial extra cost?