Sounds reasonable, until you look at the Silicon Valley experience. Silicon Valley grew like a weed precisely because employees could…

This Week in HIT 8/23/13

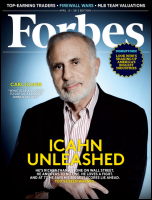

Nuance Recognizes Icahn’s Voice as Hostile

Facts and Background

The board of speech recognition giant Nuance Communications, alarmed by the rapid accumulation of its shares by billionaire investor and corporate raider Carl Icahn, adopted Tuesday a shareholder rights plan (aka “poison pill”) that prevents any outside investor from holding more than 20 percent of the company’s shares.

Opinion

With Nuance shares up only 22 percent in five years and considerably lagging the Nasdaq after some company stumbles this year, are Nuance’s board members protecting the interests of shareholders or their own?

Musings

- It’s at least flattering to attract Icahn’s financial interest. At the moment he’s pursing Dell and his August 13 announcement that he’s buying Apple stock sent shares up 5 percent.

- Icahn owns 16 percent of the outstanding shares of NUAN.

- Ican is worth $20 billion, mostly made by buying downtrodden companies and selling them off in pieces.

- Healthcare (Dragon, eScription, transcription services) is Nuance’s bread and butter at about 50 percent of revenue, even though the company is mostly known outside of the industry as providing the technology behind Apple’s Siri and voice-powered appliances.

- Icahn’s tactics after he gains control of a company involve replacing the board, then breaking the company up if the share price doesn’t respond.

- Historically, shareholders receive significant benefit if the companies Icahn controls either are taken private or are acquired, but suffer if they remain independent.

We’re Not Intuit Any More: Medfusion’s Founder Buys it Back

Facts and Background

Steve Malik, who founded patient portal vendor Medfusion in 2000 and sold it to Intuit in 2010 for $91 million, confirmed Tuesday that he has bought his former company back.

Opinion

Intuit joins Misys and Sage as examples of why nobody benefits when financial software firms decide to dabble in industries they know nothing about, especially ones involving patients.

Musings

- Cary, NC-based Medfusion had taken in only $2.2 million in outside investment when Intuit bought it, so Malik must have made a fortune back in 2000.

- Malik bought Intuit Health back at an unannounced price, likely a lot less than $91 million since its revenue was declining despite increasing physician adoption.

- Malik says he hasn’t decided whether to revive the Medfusion name.

- Intuit announced that it was seeking a buyer on August 1, when it announced unimpressive quarterly results.

- Intuit wrote down an astounding $46 million in May 2013 after Allscripts, its biggest customer, bought portal vendor Jardogs in March 2013 after years of being stuck with its earlier (dumb) decision to market rather than build a patient portal to complement its EHRs.

Greenway’s Subscription Wasn’t Delivered in Q4

Facts and Background

Greenway announced a wider than expected loss and decreased revenue in its earnings report Monday, blaming its shift toward a recurring revenue model.

Opinion

Competition, the HITECH slowdown, and regulatory development costs are making it tough to meet lofty expectations in the ambulatory EHR world.

Musings

- Like all software companies, Greenway is trying to wean itself off sales-driven revenue and move toward a recurring revenue model involving maintenance fees, training fees, and add-on services such as revenue cycle management. Like most software companies, they aren’t finding it easy, especially while doing it under the watchful eyes of Wall Street.

- Sales to Walgreens boosted revenue, but at reduced margins.

- The company says it expects system sales to drop 50-60 percent as it moves to subscription pricing.

- Tee Green said in the earnings call that Meaningful Use Stage1 created market “carnage” that will benefit the company in the form of more astute prospects.

- GWAY shares are up slightly on the week.

- The report wasn’t great overall, but GWAY is a work in progress having gone public only 18 months ago and share price unchanged since.

More Parking Lots for Neal to Watch: Cerner Plans a $4 Billion Campus

Facts and Background

Cerner’s planned development of a 251-acre abandoned mall site will be the biggest office development in Kansas City history, eventually housing 15,000 employees.

Opinion

Campus projects are a good indicator of company optimism, and even though taxpayers will be on the hook to give Cerner $1.2 billion in tax incentives for a 70-30 private-public split, a capital project of this magnitude indicates a lot of confidence about the future for a company whose market cap is $16 billion.

Musings

- Cerner will put $8 million into a fund intended to improve the seed neighborhood that surrounds the abandoned mall.

- Cerner employs 9,000 in the Kansas City area.

- Cerner will buy 221 acres of the property from co-founders Neal Patterson and Cliff Illig.

- The former Bannister Mall closed in 2007 due to suburban flight and rising neighborhood crime drove customers away. It was torn down in 2009.

- The site is near Cerner’s Innovation Campus.

Contacts

Mr. H, Inga, Dr. Jayne, Dr. Gregg, Lt. Dan, Dr. Travis.

More news: HIStalk Practice, HIStalk Connect.

Re: Nuance Recognizes Icahn’s Voice as Hostile. Good summary of the Icahn-Nuance situation so far. Post-Icahn outcomes sound about right, but would be interesting to see performance stats for companies post Icahn control, by disposition (taken private / acquired vs remain independent.”).

Re: More Parking Lots for Neal to Watch. Given Cerner’s reputation for innovation, maybe they can create some software for lot image analysis algorithms – Automated Lot Analysis & Reporting Module (ALARM)….